By AM Golden

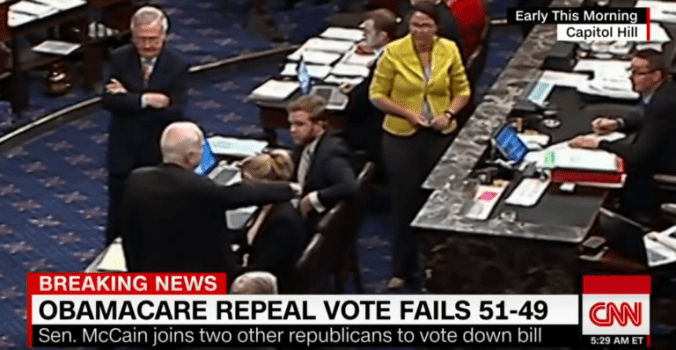

[I’m grateful to AM Golden’s guest post for many reasons, among them the chance to revisit (above) the moment when the late Senator John McCain‘cast a petty and unethical vote to save the Affordable Care Act, which he had opposed, from repeal just to spite Donald Trump. I am also glad, I guess, to have AM remind us of the decietful manner in which it was passed, with Democrats insisting that the ACA was not a tax, then later defending it before the Supreme Court on the grounds that it was a tax. JM]

One of the government expenditures I’d like to see looked into by DOGE is the cost and usefulness of the Affordable Care Act, particularly the tax subsidy

Full disclosure: I work for a nationwide health insurance company.

Not long ago, I commented how taxpayers are often gouged when the government spends our money. We’ve seen inflated prices by government contractors. We’ve read about the massive fraud perpetuated by those who got loans during the Pandemic to allegedly keep their businesses afloat. I suggested in that earlier comment that the availability of student loans has doubtlessly caused tuition rates to rise. The temptation of bottomless coffers of cash is hard to resist. I suspect it has resulted in higher costs for medical care submitted through Medicare/Medicaid. I noted then that government-paid health care would cause medical costs to go even higher.

It isn’t that U.S. citizens aren’t sympathetic to people who are sick, especially to those severely injured in accidents through no fault of their own or born with congenital conditions. In the 1990’s, government regulations established, among other things, requirements that health insurance carriers offer two of their most popular plans as Guaranteed Issue plans for those who could not get insurance elsewhere. These plans were expensive, but they put the onus for paying on the policyholder and not the taxpayer. It was a step, but, like other attempts at helping sick people get coverage, it didn’t address the cost of medical care.

And neither would the next attempt.

Among the most bloated pieces of legislation – as well as one of the most unethically presented – is the Patient Protection and Affordable Care Act signed by President Obama in 2010.

At its inception, the Act, often shortened to ACA and colloquially known as Obamacare, was presented to give comprehensive medical insurance at affordable rates to Americans and to expand Medicaid for those who could not afford even the lower premiums it was claimed the ACA would produce.

The idea was that a large pool of young, healthy adults would make enough premium payments to balance out the claims that would be filed by the chronically ill and the elderly. Applicants that fell beneath 400% of the federal poverty line for their household size would be eligible for tax subsidies to lower the premium and/or to reduce deductibles/coinsurance/copays. To enforce compliance with the Act, those who did not have a qualified health plan would be subject to a tax penalty.

President Obama assured Americans that it was not a tax. He claimed that Americans would be able to keep existing plans if they preferred. Speaker of the House Nancy Pelosi insisted that the legislation could only be analyzed after it was passed.

And, thus, it was. After a challenge brought it to the Supreme Court, though, the high court decided it was constitutional because it was a tax. Then Americans found out they couldn’t always keep their doctors or even their plans if they made changes like increasing the deductible to lower costs.

Furthermore, because Americans are so contrary, reality didn’t quite meet the administration’s expectations for how it would work. Young, healthy people did not flock to the ACA. Once they realized how much these so-called affordable plans actually cost, they began taking out short term plans instead. The tax penalty was low enough that it still made economic sense to go with lower cost plans with reduced benefits and durations.

People in need of pricey surgeries were taking out these plans – often getting substantial tax subsidies and cost-sharing benefits in the process – having the surgeries and then cancelling the plans. Again, the tax penalty was low enough to make doing so an attractive option. A significant percentage of the first quarter claims my employer paid out were for about six people who did just that: took out the plans, had the surgeries and cancelled the policies.

Elections have consequences, after all. I do ask for some grace here because I realize that the analogy of a restaurant isn’t perfect, but it’s what I know. Besides what I’ve listed above, the ACA produced the following:

- Consequence #1: Required additions=increased premiums. The ACA mandated that all major medical plans written after a specific date were required to have certain benefits on them, even if the policyholders would have no reason to use them. For example, all major medical health plans – regardless of whether they are provided by an employer or purchased by an individual – must have maternity benefits on them even if the policyholder is only a single male. Or a married couple past childbearing years. Pediatric dental and vision must be included on the plans even if the policyholders have no children or plan to do so. These benefits had formerly been handled by many carriers as optional benefits that customers could add to their plans for an additional fee. Now, everyone had to have them whether they wanted them or not. As you can imagine, required benefits caused insurance premiums to go up. Imagine fast food restaurants being required to add lettuce and tomato to every sandwich even if the customer doesn’t desire them. Who does the higher cost get passed to? The consumer! I’ve seen premiums for applicants that are higher than my mortgage payment!

- Consequence #2: Eliminating variety=eliminating options. Prior to the ACA, seniors retiring early often took out catastrophic plans that would only cover severe injury or illness to save some money until they got to Medicare. The Affordable Care Act required that catastrophic plans could only be taken out by people under the age of 30 and only if they provided proof to the IRS they could not afford any other option. This requirement eliminated a low-cost choice for otherwise healthy seniors who just needed basic coverage for a year or two until they reached Medicare age. It’s like offering a Blue Plate special but requiring the restaurant to check ID and the customer’s wallet to make sure they can’t afford a more expensive meal.

- Consequence #3: Ever hear of the Medical Loss Ratio provision? Basically, it’s the part of the ACA that requires a specific percentage of premiums paid be used for claims. No more than 20% can be used for administrative costs or profits. If carriers don’t meet the 80/20 threshold, the difference has to be rebated to the policyholder. Suppose your local fast-food place charged $1.00 for a large soda. Under this requirement, 80% would have to go toward giving you the product you paid for and, if the restaurant should use more than 20 cents for admin costs and profit, it would have to refund you the difference (On a tangential note, you think $1.00 for a large soda is a deal? You have no idea how very little that soda costs the restaurant. $1.00 is a huge mark-up. The paper cup costs more than the soda does. Don’t get me started on $3 or $4 drinks in sit-down restaurants!).

- Consequence #4: Restricting Trade. In 2016, when it became clear that the ACA was not bringing in the young, healthy people it had hoped to draw, the bureaucrats at CMS requested permission to restrict short term plans to three months in duration and only one per lifetime. They were granted permission for the former, but not the latter. Suddenly, insurance carriers could only offer short term plans that were three months long at max. Some carriers dropped short term products. Others began focusing on fixed indemnity products only for the government to decree that customers have to be made aware that the coverage is not ACA-compliant with required verbiage that’s the equivalent of knocking someone over the head with a hammer and asking, “Are you sure you want to buy this? Are you sure?” The first Trump administration reversed the short term ruling, allowing short terms to go back to a max of 12 months which is how it remained until last September when the Biden administration limited them again – this time to 3 months with a maximum 1-month extension. It’s as if they don’t want any plans competing with the ACA plans so they use the power of the government to restrict the product that can be offered. Frankly, I consider this to be an unfair trade practice. Imagine the government ordering the fast food giants to sell pricey gourmet burgers and then telling the restaurants they can’t sell basic burgers with just ketchup and mustard.

- Now let’s talk about the subsidies. A health insurance applicant fills out how much money he or she makes per year (the ACA website application will question if the amount they are reporting is significantly different from government records. This can happen if an applicant has been laid off or had working hours reduced, but also because some people just lie). If the applicant is given a subsidy–and I have seen subsidies that reduce a plan costing several hundred dollars per month to less than $100–proof of the reported income has to be supplied to the IRS at tax time. If the applicant underreported income, the tax subsidy can be taken away and the policyholder would have to pay back the amount of the subsidy received. Ideally, this is how it’s supposed to work to catch the Americans who are always looking for loopholes.

Now, we are dealing with the IRS here, which has a reputation for digging up every bone buried in the yard by every dog that’s ever lived. The compassion urged by those on the Left who demand forgiveness of debt for everything from tuition to health care does not exist in the IRS. I am willing to stipulate that the IRS may very well demand every cent from an ordinary taxpayer who was given a subsidy based on incorrectly reported income.

But this game of reducing insurance payments through tax dollars and demanding repayment if the applicant is wrong, either deliberately or not, doesn’t sit well with me. I think I want to know exactly how much money the U.S. taxpayer is shelling out to pay for other people’s subsidies on inflated premiums caused by government regulation and how much is actually being repaid when there’s been an error. I want to know about the government-paid assistors who walk applicants through the application when they have a problem with the website. These assistors often try to sell the applicant a different plan and take credit for it, leaving the agent out in the cold. I want to know how much certain medical procedures went up, especially for those benefits, such as mental health treatment, that became required for all major medical plans.

I think we should know just how many people have been helped by this. Don’t you?

Awesome post!

Highly informative and detailed post. I have argued over and over again that the ire aimed at insurers is misplaced. Insurers pay bills the patient incurs. They negotiate with practitioners who accept the patient/insurer’s insurance.

Cost containment maybe in the lexicon of hospital administrators or practice managers but any cost savings merely permit more lavish amenities for those who provide health care services. Cost containment will rarely if ever result in lower prices for health care payers.

Why are states unable to limit how much medical care providers can charge for their services?

Some states limit how much grocery stores can charge for bags.

Why is medical care different?

This is a great post with awesome information. Can I copy it down for my next debate with an insurance hater?

Sure. Most of it is public information anyway. People just don’t bother to look for it.

Michael,

Price controls have demonstrably harmed the marketplace everywhere and every time they have been used. Restricting prices will only limit access, as providers will eliminate procedures and services that don’t at least break even. Unlike retailers, the medical industry doesn’t use ‘loss leaders’ to attract customers.

Ultimately price controls will disincentivize careers in medicine. It takes 10 or more years to become a doctor, at great cost and personal sacrifice. Who will work that hard if there isn’t some financial incentive? Yes, there are money grubbing a-holes in medicine, and there are those who just want to heal and help. The vast majority fall in the great middle, men and women who work long hours, invest in continuing education, who shoulder huge economic liabilities and malpractice premiums for a public that expects perfection, and who exercise professional diligence and integrity in the practice of medicine.

According to the AMA, there is currently a doctor shortage in America, expected to worsen in the next 10 years. By 2034 the shortages are projected to fall between 37,800 and 124,000, including all fields medicine. Price controls will likely increase the shortages.

The costs of medical care in this country are high, but there are elements that can be improved. I personally look forward to the new DHHS shaking up the food, drug and medical industries to improve our health, reduce our exposure to harmful substances and, hopefully, reduce costs.

“According to the AMA, there is currently a doctor shortage in America, expected to worsen in the next 10 years. By 2034 the shortages are projected to fall between 37,800 and 124,000, including all fields medicine. Price controls will likely increase the shortages.”

The AMA creates the shortages by limiting access to training much like the Bar associations limit the number of lawyers minted each year. What is the AMA doing to rectify this situation. Very little because it benefits them to be in short supply. Not every ailment requires a doctor but doctors must oversee every ailment treated. PA’s and CNP’s are a good start but they too have limitations.

Price controls do distort the market but what we have is market failure because there are too few, if any, substitutes for the services in question. The medical community knows this and the entire supply chain prices its services accordingly.

The key to bringing down health care costs is two fold: Americans need to adjust their diets and increase exercise; and, the we need to increase supply of practitioners by bringing down (subsidizing) the costs of training and getting the AMA out of the process. Existing doctors have no business determining how many new doctors or their equivalents will be coming online.