Hmmmm. Well THAT certainly enhances my trust in my bank!

Hmmmm. Well THAT certainly enhances my trust in my bank!

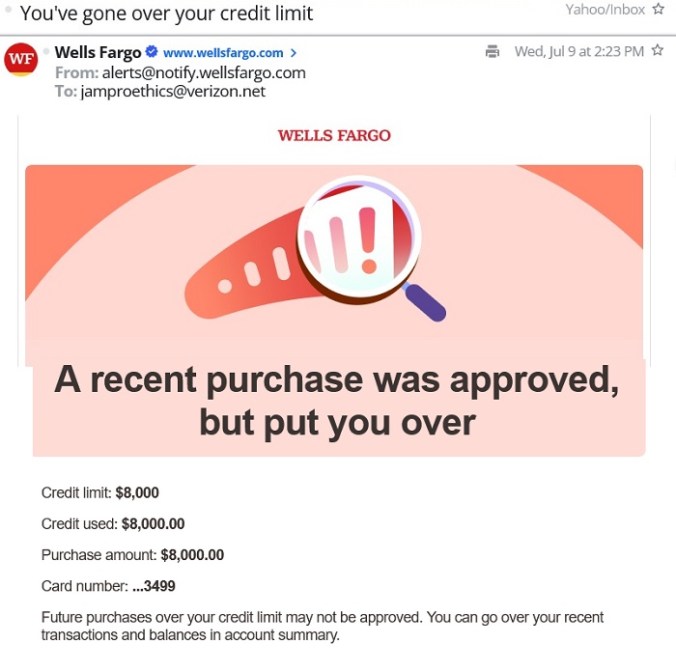

As I told the Wells Fargo customer service agent (“second line!”) when I finally got through to one, I don’t need this. My wife’s sudden death put me in financial hell, punched my business in the metaphorical solar plexus, and sent me on a harrowing odyssey to repair my economic state—debts, credit, taxes—regarding problems I didn’t even know existed. Messages from my bank telling me I am over my credit limit causes my adrenaline level to shoot through the top of my head. Yes, a home repair financing arrangement required me today to employ a new credit card for the full amount: I thought that’s what it was for. Silly me. Foolishly, I didn’t realize that charging $8,000 for an $8000 purchase on a credit card with an $8,000 credit limit would cause me to go over that credit limit.

But I’ve never been good at such matters.

When I called Wells Fargo and asked why I had been sent that alert, I was told that they had no idea. Just fooling around, I guess. Just screwing with me. “I’m sorry. I guess the computer just sent the wrong email,” was the best I got.

Oh.

I pulled my accounts out of Wells Fargo during their last scandal, and came back when I discerned that they were no longer crooked there. Now they’re just stupid and incompetent.

Jack a new card with one transaction for the full amount set off their fraud alert. It appears that WF honored the purchase and this email was triggered by hitting the credit line.

It is unfortunate that the email caught you off guard while not in an ideal place but that is the price of impersonal automated services.

All rationalizations. It’s unfortunate that the %$#@$%! incompetent bank’s computer can’t add. If a depositor properly using his card sets off a fraud alert, then the programmer is an idiot. “That’s the price of X” is not an excuse or an explanation, just a shrug. The BANK is committing mail fraud! It’s the bank’s computer,it is responsible, and it just lied to me causing personable distress…and the answer is, “Oh well”?

What if it merely said the transaction looked suspicious, instead of saying you were “over the limit”?

Jack, how does the computer know who is using the card? I have gotten declines on a card -Amex- when the purchase is way out of the ordinary. When that happens I call and get it corrected. I don’t disagree that it is inconvenient and embarrassing when it happens but I also realize that in today’s world identity and credit card theft is rampant Typically the algorithms employed look for anomalies and using a card for the first time and up to the maximum limit is a significant anomaly. I do agree that a fraud alert specialist should call to verify the transaction the minute it suspects possible fraud.

I have to wonder how many people take their line to the exact maximum without going over. That email was most likely programmed to be sent when the customer reaches or exceeds the credit line. That is not necessarily incompetence it is based on an expectation of consumer behavior.

Followup:

I would agree that the email message is incorrect if you did not immediately go over the limit. Furthermore, WF programmers could easily have a different message saying you are at your credit limit and future purchases may not be honored but that would suggest they might be so they would have to say they will not be until the balance is paid down. The point is there is no specific message tailored to each customer that can be made automatically.

I believe this email was a warning email that you were dangerously close to incurring over limit fees and it was a legally defensible way of stating that the card holder charges may be declined in the future or, if not declined, accepts the consequences of over limit fees.

The question becomes what message would you have accepted without quarrel? Should card issuers never send messages to consumers about unusual purchases out of fear they might upset them and should consumers never complain when they are hit with over limit fees or held responsible for fraudulent use? If left to financial institutions I bet they would prefer not to give warnings and just hold card holders liable for every charge to their card no matter who incurs that charge. Credit card fraud cost banks billions (ultimately the consumer) each year.

Key Credit Card Fraud Statistics to Know for 2025

Your’re kidding, right? What message would I have accepted? How about an accurate one? “You have reached your credit limit on your new Wells Fargo Reflect card. Future charges will put you over the limit until these charges have been paid. Wells Fargo may decline future charges in that event.”

How hard is that/

Wells Fargo is terrible. My daugher deposited $300 cash because she was going on a plane and they don’t take cash. They informed her she was unable to use the amount for 3 business days.

A few thoughts:

1. Going over your credit limit isn’t necessarily the end of the world. I’ve had credit cards I used for a high turnover business that I would repeatedly cycle through, maxing them out and paying the entire balance multiple times every month. I would frequently go over the limit by large margins with no ill effect. Since this is your first time using the card, though, I doubt the bank would allow that.

2. There are three consequences I can think of for going over your limit. First is the obvious inability to use the card until you pay down the balance.

Second, the bank might charge a fee for being over the limit.

Third is the impact it will have on your credit score. One large factor in determining your credit score is the percent of your available credit you are using, both on individual cards and in aggregate. Ideally you use less than 10%. Going over 75% is really bad. Over 100% is really really really bad. The credit score hit will be significant. On the plus side, the hit is temporary. It updates once a month based on the statement closing balance, so if you’re back under the limit on the next closing date the credit score hit will vanish. On the negative side, though, you might experience various I’ll effects during any month your credit is down. If you’re applying for new credit you might see higher interest rates or be denied. If your score is bad enough you might see existing credit lines downsized or even closed.

3. If you want to avoid going over the limit, being at the limit is a precarious place to be. The interest charges or fees might unexpectedly put you over.

Thanks for the considerate advice, Jon. I do all know all that, because I have been rescuing my credit score that crashed when the stupid lockdown wiped out my business and when my wife defaulted on our mortgage without telling me (in fact, telling me the opposite until the foreclosure notices started coming.) I have raised my credit score almost 200 points since her sudden death, paid off longtime creditors, paid bills ahead of time, and have incurred no credit card fees or late payments on those cards, again, for almost two years. That credit card was a brand new one, pushed on me by Wells Fargo, with no interest charged for 22 months. (I don’t need another card except for the extra credit. I have two, including Amex.

The two-day old card had no charges on it yet, and I used it to set up a major home project that my credit report (I suspect because of the mortgage fiasco) prevented me from getting a full loan for, so I needed an immediate downpayment—which was exactly the kind of thing the card is for, according to Wells Fargo. And they slapped me around for it anyway.