A study of I.R.S. data by a University of Chicago graduate student, now Doctor, Oscar Vela, produced the following list of the professions most likely to file fraudulent tax returns, at least according to his analysis. Make of it what you will. The Time Magazine website blog post about the list is worth reading, first for the blogger’s highly questionable theories explaining, for example, why lawyers aren’t on it, but mostly to see conclusive proof that Time is hiring English-as-a-second-language night students, relatives of Ko-Ko the talking gorilla, or stroke victims to write their blogs. Sample sentence: “His conclusion was that as much as we would like to think so we pay taxes out of the goodness of our hearts, or even because we are fearful of fines or worse.” Henry Luce just did a back-flip in his grave.

Dr. Vela’s theory is that the professions that are required to maintain a perception of integrity are less likely to cheat. Let us say that I am dubious. Why then are scientists so high on the list?

Here it is:

1) Production Workers – bakers, butchers, factory workers, jewelers

2) Building and Ground Maintenance – cleaning staffs, janitors, landscapers, pest control workers

3) Transportation and Material Moving Operations – bus drivers, parking lot attendants, movers

4) Construction Trade – contractors, electricians, house painters

5) Install, Maintain and Repair – auto mechanics, home appliance repairmen, locksmiths

6) Life, Physical and Social Sciences – chemists, economists, zoologists

7) Protective Services – crossing guards, firefighters, police, security guards

8 ) Personal Care – childcare workers, funeral attendants, manicurists

9) Arts, Design, Entertainment, Sports and Media – actors, editors, public relations specialists

10) Healthcare Support – dental assistants, home health aides, massage therapists

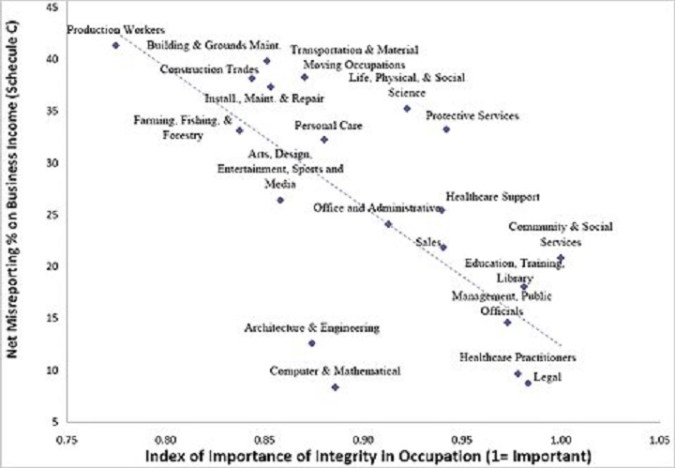

And here’s the graph from Vela’s dissertation, plotting the professions’ incidence of cheating against their supposed “index of importance of integrity,” whatever that is.

His graph is labelled mis-reporting. How did “mis-reporting” become “cheating”. The professions he thinks are likely to cheat are by large, blue collar professions which may make them more susceptible to errors. Conversely, with a less incidence of “uncovered” mis-reporting, it could be theorized that professions, such as lawyers, are more apt to find the loopholes and disguise their tax liabilities without getting caught.

Keep going! I thought all of the above….what else?

The graph is 100% based solely on people who filed Schedule C who operate in these industries as personal businesses. These are people who started their own business and don’t work for a company. 100% of their income is self reported….for everyone on the chart.

To continue on with the problems with his analysis, I would think that there are fewer small business / individuals as a business entities in the blue collar arena than say the legal profession.

For an example, my assumption would be that while 4 out of a total 10 movers had a mistake in their reported income, 100 in a 1000 lawyers made a mistake in their reported income. If the blue collar group sizes were significantly smaller than the white collar, I’d be interested in comparing a different sample that compared like sample sizes. If we extrapolated the data out from the smaller blue collars, would it remain at 40% or would it fall?

Also, since all of these people have “Small Business Owner” in common, it says nothing of the industry of professionals that work for someone else or for companies.

Tim, it’s not just that so much of those particular cheaters income is self-reported (though that’s a-lot-to-most-of-it) it’s that they have so many opportunities to make deals under the table. Taking payment in cash, for example, or barter (I’ll build you a sundeck, you clean my family’s teeth).

I’d be more interested in the break down of details- like how many of these people filed schedule C, etc? I’m tempted to think that people in any profession who file extra bits like that (which already raise their audit risk) might be more careful. And honest.

And like Tim, I’d like to see a breakdown of honest errors vs. actual cheat. But that’s harder…

Frankly, I think you could stand this chart bottom side up and get a more accurate picture. Who does Dr. Vela’s taxes, I wonder? Or Time/Life’s, for that matter?

I find it interesting that the clearest outliers are “Computer & Mathematical” and “Architecture & Engineering”–these are people who work a lot with numbers despite the relatively lower “importance of integrity” in those fields.

This appears to support the theory that “misreporting” really means “errors”.

–Dwayne

In that context, Dwayne, who would be better at “fudging” the numbers on their own taxes than those who handle mathematics for a living?