You use the culture, markets, resources and freedom of the United States to turn your innovation into a fortune, and when your nation needs you, more than ever, to contribute your fair share to address its serious economic crisis, you decide to flee to foreign shores.

That’s Facebook co-founder Eduardo Saverin.

Despicable.

Occupy Wall Street and its offspring engage in slander and bigotry by characterizing all wealthy, successful individuals as selfish leeches, but their stereotype fits Saverin like a wetsuit. As his company is poised for a public offering and his shares in it are about to lay golden eggs, he has decided to give up his citizenship, and his tax obligations, to live in luxury in Singapore. This will save him at least 67 million dollars in taxes, and probably more. His lawyer-spokesman says that the timing of Saverin’s exodus is coincidental; he just had an overpowering desire to live in Singapore.

Right.

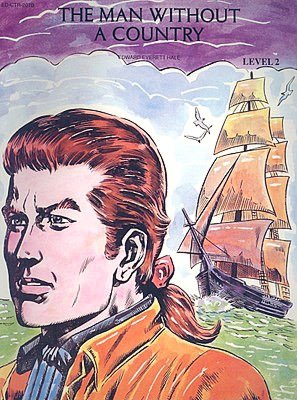

Well, good riddance. The U.S. needs his money, and had a right to it, but it doesn’t need him. He is an ungrateful, greedy and selfish wretch, and richly deserves to be remembered as this generation’s Philip Nolan, “The Man Without A Country.”

__________________________

Facts: Bloomberg

Graphic: Barnes and Noble

Ethics Alarms attempts to give proper attribution and credit to all sources of facts, analysis and other assistance that go into its blog posts. If you are aware of one I missed, or believe your own work was used in any way without proper attribution, please contact me, Jack Marshall, at jamproethics@verizon.net.

Good for him, I think it’s the American people who should be grateful for what Eduardo Saverin and others like him have contributed to our culture, resources, markets and freedom and not the other way around.

In fact, the appreciation should be mutual.

Good for him, indeed. FATCA is one of the biggest reasons for the growth of expats in the past few years. Maybe Saverin did renounce his U.S. Citizenship for greed, but when looking at the generally less profiled expats, doing business in a foreign country while staying overseas in said country has been impossible due to the onerous nature of strict controls on capital. Foreign banks have been refusing those with U.S. Citizenships as the result of FATCA. I would like to compare said act with the failed SOPA, in that their initial intentions would be realized, but the shortsightedness and broadness of the laws inadvertently to cost people more jobs. I know this, as I have been considering to become a youtube partner, and SOPA would make such a job opportunity unavailable. Same with FATCA, which may in fact (I did quick google search for this) cost more to implement than what it earns back.

As for Saverin, his role with Facebook has contributed to an abundance of job offerings from Facebook due to big investments from others, the same investment Saverin’s been making in Singapore for a while. Such investments always encourage job growth, which Facebook has been performing well in that respect considering how many people are out of a job nowadays.

America is the largest market in the world and it has some of the world’s best universities. Many wealthy non-citizens therefore owe their wealth to America’s “culture, markets, resources and freedom”, either because the product they sell is popular in the United States, they obtained their education in the United States. Unlike citizens, they only pay taxes on income made in the US, rather than worldwide income. Is there a reason why US citizens who live abroad should pay more in taxes than a non-citizen who has similarly benefited from the US?

And people wondered why I didn’t believe a word of The Social Network.

Do you have that same attitude concerning the Exodus described in tjhe Bible?

Did Pharaoh have a right to Hebrew labor?

Don’t you think comparing the travails of Hebrew slaves who labored under the whip for centuries to a free entrepreneur who made millions under the protection and benefits afforded by American rights, freedom, power and law is offensive, not to mention silly as hell?