Someone at the IRS finally leaked the President’s taxe returns to the Times. That’s a crime, just as it would be if someone leaked my taxes or yours. Of course, this was inevitable, filled as the government bureacracy is with unethical employees who feel it is their duty to try to undermine their ultimate supervisor. Those who cheer on this per se wrongful conduct are enabers and rationalizers.

Other points:

1. In “An Editor’s Note on the Trump Tax Investigation,” the Times felt it necessary to remind readers, “Some will raise questions about publishing the president’s personal tax information. But the Supreme Court has repeatedly ruled that the First Amendment allows the press to publish newsworthy information that was legally obtained by reporters even when those in power fight to keep it hidden. That powerful principle of the First Amendment applies here.” That’s right, the news media has a right to encourage others to break the law and to publish the results. It’s still unethical, except in the rare circumstances where the public interest is indisputably served by furthering an illegal act, as with (arguably) the Pentagon Papers. Publishing documents protected by law that show no wrongdoing only to encourage partisan attacks in an election year is not such a situation.

The Times can’t be punished, but whoever leaked the documents can, and should.

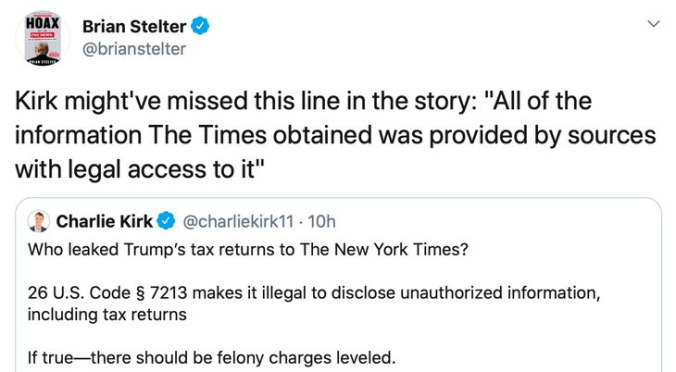

2. I guess this is the time to post this tweet by CNN’s Brain Stelter, which proves his stunning ethical deficits as well as anything he has ever said on CNN. He was responding to another tweet pointing out that leaking tax returns is a crime, as I just did.

Oh! So if Stelter knows he has received embezzled funds from a bank employee, Stelter can spend the cash on a hairpiece because the thieving employee had legal access to the cash!

Has any news network simultaneously employed three dolts as mentally deficient as Stelter, Don Lemon, and Chris Cuomo?

3. The President termed the “bombshell” “fake news,” as well he should have. The Times headline calls the tax returns “long concealed,” which is misrepresentation—they weren’t any more “concealed” than my taxes are. The people authorized to see them, saw them. The President wasn’t “hiding” his taxes, just as T. Boone Pickens didn’t hide his taxes. That both chose not to release them publicly to prevent exactly the kind of cheap, low-information voter-aimed negative spin we are seeing now was completely reasonable and ethical.

4. I have wondered if the President’s tax battles with the media and Democrats were a trap; that he knew the documents would eventually come out, and that when they did, what his foes always assumed would be there, and indeed what they were obviously looking for, wouldn’t. That, of course, is any indication of illicit contact with the Russians. There’s nothing there. All the efforts now to see something sinister in the returns is desperate face-saving.

5. Senator Cory Booker tweeted, “First, we must vote this man out of office. Then, we must change a tax system so deeply flawed that he could get away with all of this.” Brava for Ann Althouse, who deftly puts Booker and similarly inclined Democrats in their proper place, as she wrote:

It’s unAmerican to use the phrase “get away with” to refer to following the law. It’s like accusing me of speeding when I’m going 75 in a 75 mph zone. I’m not “getting away with” it. I’m going the speed limit! Change the speed limit if that’s the wrong top speed. Crimes are the things that have been defined as crimes. It’s particularly irksome for a legislator to talk like that — shifting the blame for the legislature’s own failures.”

And..

“Why didn’t Joe Biden work on changing the tax laws in all those decades in Congress? He’s responsible for the system that Trump, as a private citizen, was forced to operate within. “

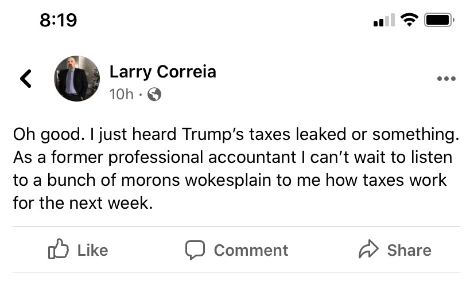

6. Accountant Larry Correia tweeted last night,

He used this as his introduction to a hilarious and spot-on post today he calls, “No, You Idiots. That’s Not How Taxes Work. – An Accountant’s Guide To Why You Are a Gullible Moron.”

He used this as his introduction to a hilarious and spot-on post today he calls, “No, You Idiots. That’s Not How Taxes Work. – An Accountant’s Guide To Why You Are a Gullible Moron.”

He writes in part,

First off, “morality” doesn’t have jack shit to do with taxation. You pay what you legally owe. Nobody willingly pays the government more than they legally owe.

This has always been this way since America has had income taxes. There is endless court precedent. You pay what you legally owe. That’s it. If you pay less than you legally owe, then the government will fine or imprison you. If you pay more than you legal owe, the government will laugh and laugh, because you are an idiot, and you deserve to be poor.

Every single person who barks about how somebody else should be paying more? They themselves are paying the minimum they can get away with. As they should. As should you.

I remember when I was taking my first tax class back in college. This class was all accounting majors by this point. At the beginning of the semester the professor (who’d had a long career as a tax guy) gave us an imaginary family as our clients and had us do their taxes. One kid didn’t take advantage of all the obvious deductions for his clients. When the professor asked why, the kid said some mushy thing about how he didn’t think it was FAIR to keep that money from the government… Holy shit. The professor ripped this kid a new asshole. HOW DARE YOU!?! IT IS NOT THE GOVERNMENT’S MONEY! IT IS YOUR CLIENT’S MONEY. YOU OWE THEM YOUR BEST! IT IS YOUR SACRED DUTY TO SAVE THEIR MONEY! YOU DISGUST ME AND YOU SHOULD NEVER BE A CPA!

That class was one of my favorites.

Basically, you pay what you owe, no more, and anyone who claims otherwise is full of shit.

Bingo.

Most likely it was someone in the Manhattan DA’s office, which did get the records from Deutsche Bank. Cyrus Young has been out to get Trump since 2016. The mainstream media are trumpeting that this is where Trump loses control of the game and he is on the defensive for tomorrow. The more I think about it, the more I think the polls might NOT be so wrong, and, in any case, the Senate is probably a lost cause.

But, if that is the case, Vance didn’t have the right to release them. Even if the DA has them they are still confidential and releasing them is a violation of Trump’s privacy rights. Vance and his team should be sanctioned by the court (yeah, I know – fat chance, but hope springs eternal). If Stetler is correct (which I highly doubt, because he is an idiot), that means they came from either Vance or the IRS, then where did Vance or the IRS get authority to release them to the NYT? FOIA wouldn’t allow it.

jvb

I don’t know how I missed that, but yes, Steve did point at the DA’s office first. I don’t think either of us meant to insinuate that releasing those documents to the NYT was legal, only that it probably didn’t come from the IRS.

Yes, that was also the conventional wisdom in 2016.

Nah.

I doubt the tax documents will lose Trump a single vote, and it will gain some. It also furthers the Press’s disgrace and lack of credibility.

Recency bias, Jack…

No, just my usual impeccable powers of analysis.

I agree. I mean, aren’t most of those who were already inclined to vote for Trump at least somewhat inclined to be anti-tax, anyway? How would the knowledge that Trump pays good accountants to effectively minimize his tax liability hurt him with anyone who isn’t a class-warfare ideologue?

Had something illegal been uncovered, it might be a different story. But this dud “bombshell” actually works against some of the anti-Trump narrative – there’s no evidence of any Russian corruption, and Trump has actually *lost* money by being President – the opposite of the corrupt self-enrichment he’s been accused of by TDS sufferers.

I’d have to check, but it’s likely that Trump has paid either the most or second most taxes of any President.

P.S. The NYT already declared its job to be getting Trump out of office, no matter how.

I think it was a trap. Or, at the very least, a diversion.

If Obama had produced his birth certificate right away, he could not have used it to beat up his critics.

Same with Trump; he could have released them, but, as long as he held back, he knew they would continue chasing their tails.

Now, he can turn around and say that they wasted all their time over something that was nothing.

-Jut

Agreed. A couple days ago, I was watching a montage of the “one liners” that make or break an election. They didn’t show “I paid for this microphone!” or other famous lines by conservatives, but by the time of the debates between Hillary and Trump, they showed Hillary complaining that Trump paid no income taxes and he immediately interjects “because I’m smart.”

Who doubts the Clinton/Obama political machine still in power didn’t already know four years ago what only now was “leaked”?

Wait–everybody knows that the Times reports that Trump has paid million of dollars in taxes, right?

I didn’t know that, is that true or are you being sarcastic?

Sorry I don’t read them anymore.

Only the free covid scare paper in the morning…. and Trump Bashing…

Otherwise i gotta pay. OMG how funny!!!! You get Trump bashing and covid updates free every morning haha. OH.. yeah.. then a recipe I guess to make you feel better cuz now you wanna barf so maybe it will help you wanna eat?

idk… seems odd to have all this bad news then a Tika Wings Humus recipe or the like… weird birds at that rag.

No, I’m not being sarcastic! Didn’t you read the full report? This troubles me.

“HOW DARE YOU!?! IT IS NOT THE GOVERNMENT’S MONEY! IT IS YOUR CLIENT’S MONEY. YOU OWE THEM YOUR BEST! IT IS YOUR SACRED DUTY TO SAVE THEIR MONEY! YOU DISGUST ME AND YOU SHOULD NEVER BE A CPA!”

Mmm… Yes. More of this.

I joke and call myself a righteous crusader in the eternal struggle against taxation. Accountants get this.

A few months back, pre-COVID, I was in court and heard an attorney tell a judge, “Well, my client told the following . . . .” The judge was livid, but not because of COVID. He recommended that his client file a grievance against him for disclosing client confidences. The lawyer was confused. The judge’s next statement was very similar to your accounting professor’s statement. We, in the peanut gallery, simply winced.

jvb

Another good article:

https://thefederalist.com/2020/09/28/new-york-times-trump-tax-return-bombshell-is-a-joke/

A few observations I made earlier today:

Well, he has lost millions in transactions that are only vaguely described as sketchy, so it makes sense he paid no taxes. You don’t pay income tax when you have no income. He has also consistently claimed he was under audit by the IRS, and by golly, he’s been under audit for the past decade.

“Someone at the IRS finally leaked the President’s taxe returns to the Times. That’s a crime, just as it would be if someone leaked my taxes or yours. Of course, this was inevitable, filled as the government bureacracy is with unethical employees who feel it is their duty to try to undermine their ultimate supervisor. Those who cheer on this per se wrongful conduct are enabers and rationalizers.”

If I might be so bold, I’m going to present a theory:

The New York Times have stated that they aren’t going to provide copies of the documents they received. One might reasonably ask “Why?” Well, three things pop out immediately:

1) The Times is full of shit.

2) The times is mostly full of shit, but only in that they’re cherry picking, and don’t want to provide context.

3) The documents are marked in such a way that releasing them would reveal their source.

I’m going to bet three. And because the IRS and most companies don’t mark their documents like that, I’m going to bet the IRS employees are off the hook too. But you know who does mark documents like that? Police, when entering evidence. My money is on the SDNY US Attourney’s Office.

Your analysis is probably correct, which is what Steve-O stated, that the culprit is Vance’s office. Either way, the DA has no right to release Trump’s tax returns to the public.

jvb

The Manhattan DA’s office, actually, which is headed by Democrat Cyrus Vance, Jr., is the office that has been gunning for Trump. The U.S. Attorney for the SDNY is actually headed by an interim Democrat, after Trump’s last appointment started digging into Rudy Giuliani and was sacked, but she isn’t so stupid or unethical as to do that…I hope. I’d also like to think AUSAs and most of the Manhattan ADAs are not unethical enough to do something like that. Still, the staffs of both offices are large, and it only takes one attorney to be unscrupulous. I don’t think it’s the Southern District, though, since they have not been pursuing Trump.

You might not even need an unethical attorney. The Manhattan DA’s office employs huge numbers of Trial Preparation Assistants (TPAs), who are often young and transient, using the job as a stepping stone to bigger and better things, so not too worried about if it goes badly. More importantly, they aren’t lawyers, and so do not risk the severe personal and professional consequences that lawyers would for this kind of breach of confidence. I have a hard time seeing a Columbia or NYU law graduate (this office hires from the high end), who’s worked hard for three years, gotten through multiple rounds of interviews, paid his/her dues by doing ECAB on holidays and night court, and reached the level of working on a case like this, potentially throwing it all away. I have a much easier time seeing some 23yo Bernie bro just out of college, not too well screened, but entrusted with doing “grunt work” on a case like this to take the pressure off the ADAs, seeing his chance to take down Orange Man Bad by passing information to the NY Times, and quitting soon after.

I think I misremembered which DA’s office was digging through Trump’s financials. I’ll bow to your better knowledge.

My point was that the only reasons for The New York Times not to release the original copies is either: 1) they’re to some level full of shit or 2) the documents are marked in such a way as would identify the source. I think it’s probably 2, and the only place Trump’s documents would pick up marks would be as part of being entered as evidence. I suppose I’m open to alternatives, but Trump has been fighting with that DA’s office for the better part of 3 years. I’m a betting man, I’d place a wager and give odds.

How would Vance get them legally?

He wouldn’t. I’m not saying this wasn’t illegal, I’m saying that it’s probably not the IRS.

Subpoena to Deutsche Bank.

Why would the bank have the tax returns?

Didn’t a bunch of Trump’s attorney’s files get packed up by the police and carted away?

I was going to say Cyrus Vance as the source but Steve beat me to it. Words cannot describe just how stupid Stelter is. That comment surpasses Cuomo’s where he said you cannot see the data as it would be illegal but the press can.

I am actually angered that a citizen’s private financial records were published without the owner’s consent. I don’t care if it was the president’s these records have absolutely no probative value to John Q Public. Let me put it to everyone differently. What if Trump had provided his tax returns earlier but after they had been translated into ancient Aramaic. People would complain that they are unable to read them. Well guess what, the people that can read them did and found nothing improper. Therefore, giving information to people who are not trained in understanding the complex language of IRS Code can only result in misinterpretation.

On to the taxes. As a real estate mogul myself 😂 ( I have one rental property) I can attest that income from rental properties is often consumed by taxes and depreciation leaving little for operational maintenance and debt service all of which reduces taxable income. The return on capital invested from operating profit is typically less on a year to year basis than over the life of the asset because real estate tends to appreciate over time.

So, why does the Times focus on Federal Income tax instead of total tax burden? Probably because while his operating income is measured one way and capital gains/losses are measured differently. This is what Warren Buffet was referring to when he claimed he paid a lower rate than his secretary. Ordinary income is taxed at a given rate while capital gains – how Buffet derives his income – is taxed differently.

I have to assume that the Trump organization is an LLC or an S Corp. which means residual income is taxed at his personal rate. Why doesn’t the Times report the amount of payroll taxes he pays for each of his employees. Most people don’t know the employer pays a matching amount to what the employee pays. So, if Trump has 10 employees each making 125K Trump’s share of FICA and FUTA would be $93,700 all by itself. But imagine how many people actually work for Trump. I bet that Federal payroll tax number is much much higher. All of this comes out of his pocket not the workers.

Now, If we assume the assessed value of Trump Tower is 100,000,000 and NY property taxes are the same as Maryland’s combined rate at about $1.10 per hundred dollars assessed would yield state and local government’s from that one building 1.1million dollars annually. Keep in mind that is the thing that Trump uses to make his money. Now, how much do TV personalities pay in tax for the equipment they use to make their living. The answer is zero if they are simply employees. Their employer foots the bills for personal property taxes.

I am not a tax accountant but I can spot BS when I see it. The Tax Foundation (labelled non -partisan🤣 and the Brookings Institute 🤣 ) felt it necessary to state that while over 50% of the nation pays no Federal Income Tax they pay sales taxes and payroll taxes. The implication is that even though most Americans pay not one red cent in income tax they pay more than Trump. Many of these people that pay zero income tax have a negative tax rate meaning they get money over and above anything that may have been withheld from employment. The tax bill on the fuel and housing for his private 737 would dwarf most people’s annual income. To suggest Trump pays no sales tax is equally ludicrous unless we are to believe he buys nothing but tax exempt items.

One other criticism was that Ivanka got 700K in consulting fees in 2016. I would assume that was to manage the family business while dad was campaigning. But, that figure pales in comparison to the hefty salary offered to right out of college Chelsea Clinton to be a special correspondent for one of the major media organizations or her pay at the Clinton Foundation.

Lest we not forget that corporations are mobile and can move when the masses in one area make it impossible to operate profitably. If the progressives want high tax rates on high earners the earners will leave or just quit working to make more. That will cascade – not trickle – down through the economy as plants close, jobs are off-shored, mortgagees default, overdoses and suicides increase all while more and more our cities towns begin resembling Detroit.

Excellent comment, Chris.

jvb

*Accountant* Larry Correia. 🙂

Currently better know for his Monster Hunter series of fantasy novels. Read a couple, they’re entertaining. And better that you would expect from a professionally trained accountant. This sort of thing I’m sure he would find endlessly amusing.

“And better that you would expect from a professionally trained accountant.”

Hey! Accountants are often paid to be creative!

So true. I believe his first book opens with a scene where someone has a fight with his boss and ends up throwing out of a 30th floor window — and then gets offered a job, if I recall correctly.

Of course, there was the little matter of his boss being a werewolf who was trying to rip his throat out……

Fun books.

The AUC must have “bombshells” lined up to be released every single day between now and November 3rd. They really are beclowning themselves. They don’t think anyone sees what they’re doing?

Speaking as a tax preparer, I believe that anyone who legitimately had access to Trump’s tax returns would be committing a federal crime by giving them to anyone without Trump’s consent.

I am not as certain, but I suspect that publishing copies of them — without Trump’s consent — might also violate the Internal Revenue Code, whereas a journalist describing what’s in them if he illicitly received them might not be a crime.

This stuff goes beyond unethical. Anyone authorized to prepare returns or practice before the IRS would definitely have that stripped from them for doing such a thing.

What if they don’t have his taxes, but they are claiming a bunch of garbage just to get him to release his actual taxes? They have never lied about him doing bad things before…

https://www.msn.com/en-us/news/politics/ethics-experts-see-national-security-concern-in-trump-s-debt/ar-BB19x3IQ?ocid=msedgdhp

I ran across this today and it angered me that someone that professes to be an ethical advisor is weighing in on information he is not trained to understand. To suggest that Trump’s debt load poses a national security risk when the US government has nearly a thirty trillion dollar debt that now exceeds national income is ludicrous. The US debt is financed through foreign governments, US citizens and the Federal Reserve. Trump’s debt is held by private lenders not governments.

Basics of real estate finance:

Debt leverage allows a higher return on invested capital because interest the amount invested is typically a fraction of the total amount needed. A conventional mortgage that requires 20% down means that the buyer must have an initial 20% equity stake. Say I buy a house for $200,000 I only need 40K in initial equity (FHA mortgages allow much higher leverage). If I sell that house 2 years later for $250,000 (assume interest only for simplicity) My return on investment is not 25% it is 120% because I only invested 40K.

The NYT reported that Trump had 400 million in liabilities but never reported or at least does not prominently relate the corresponding asset value on the left side of the balance sheet. Owing $4,000 or $400,000,000 cannot by itself indicate financial health, other elements are essential in determining net worth, and the ability to repay.

Within that article, it was reported that Trump has hundreds of LLC’s which the ethicist says are used to launder money or hide investors. To that I say bullshit. LLC’s are used in lieu of C Corp’s to provide outside investment in a closely held firm. To build a building or develop a square block in New York or Miami requires syndication of resources to build the equity position needed to meet the debt to equity requirements of a lender. LLC’s are registered with the state just as are C and S Corps. A publicly held C Corp has tens of thousands of nameless and faceless investors whereas an S Corp or an LLC will have the names of all the stockholders (S Corp) or members LLC on the registration papers on file. So it is easy to find out who is invested in any given LLC. But why hundreds of LLC’s ? They answer lies in the various investor’s risk tolerance for a given project or if the Primary member wants to insulate Project A from Project B should Project B fail to deliver the expected results. With multiple members, each investor puts in what they want to invest in the particular project

Assume the expected cost to build Trump Tower is $100 Million of which 20 million is invested with an 80 million dollar loan. Every member is is technically on the hook for the 80 million loan unless one person gives a personal guarantee. If we assume the membership is DJT and 3 others with equal investments of 5 million each then if the property when completed has revenues of 30 million against cash expenses of 25 million for debt service and basic operations and a non-cash depreciation expense of 5 million there will be no federal tax liability yet the investors will be able to claim a 1.25 million dollar deduction for their share of the depreciation. It they are in the 38% tax bracket prior to 2016 they will reduce their tax liability on other income by $475,000. Now take $475,000 and divide it by the initial investment of 5 million. That results in a return on investment of 9.5% and the property technically earned no taxable revenue.

Here is what I have determined about the anti-Trump forces they think we are all a bunch of morons and try to treat us as such. If this is brought up in tonight’s debate I would hope that Trump says his debt load is far less a national security threat than Biden’s familial relationship with the communist Chinese who have given Hunter a billion dollars to acquire controlling interest in US commercial assets. He should point out that Biden oversaw the Solyndra scandal which cost US taxpayers $535 million and allowed the communist Chinese to buy up the assets of Solyndra for pennies on the dollar.

Math correction: For my example to be correct out of pocket expenses ( debt service, operating expenses and property taxes equals the 30 million in revenue. Non-cash expense = 5 million in depreciation. Non cash loss = 5 million.

I pulled the 30 million out of the air but Trump Tower is just under 760,000 square feet. To generate rental income of 30 million the price per square foot would be only 40 bucks a square foot. Class A offices in Maryland get more than that.

Final thought: If the tax code is changed so that losses from project A cannot offset profits from Project C then Project A will not be undertaken. If real estate development projects do not occur, construction jobs and incomes do not occur, services and income do not occur and taxes from the improvements never materialize.

Debt service on $80 million loan at 4% for 20 years is $484,784 per month or 19% of gross income. Most mortgagees have a percentage of mortgage to income in excess of 25%.